Libor 2021

The secured overnight financing rate has gained momentum in the u s.

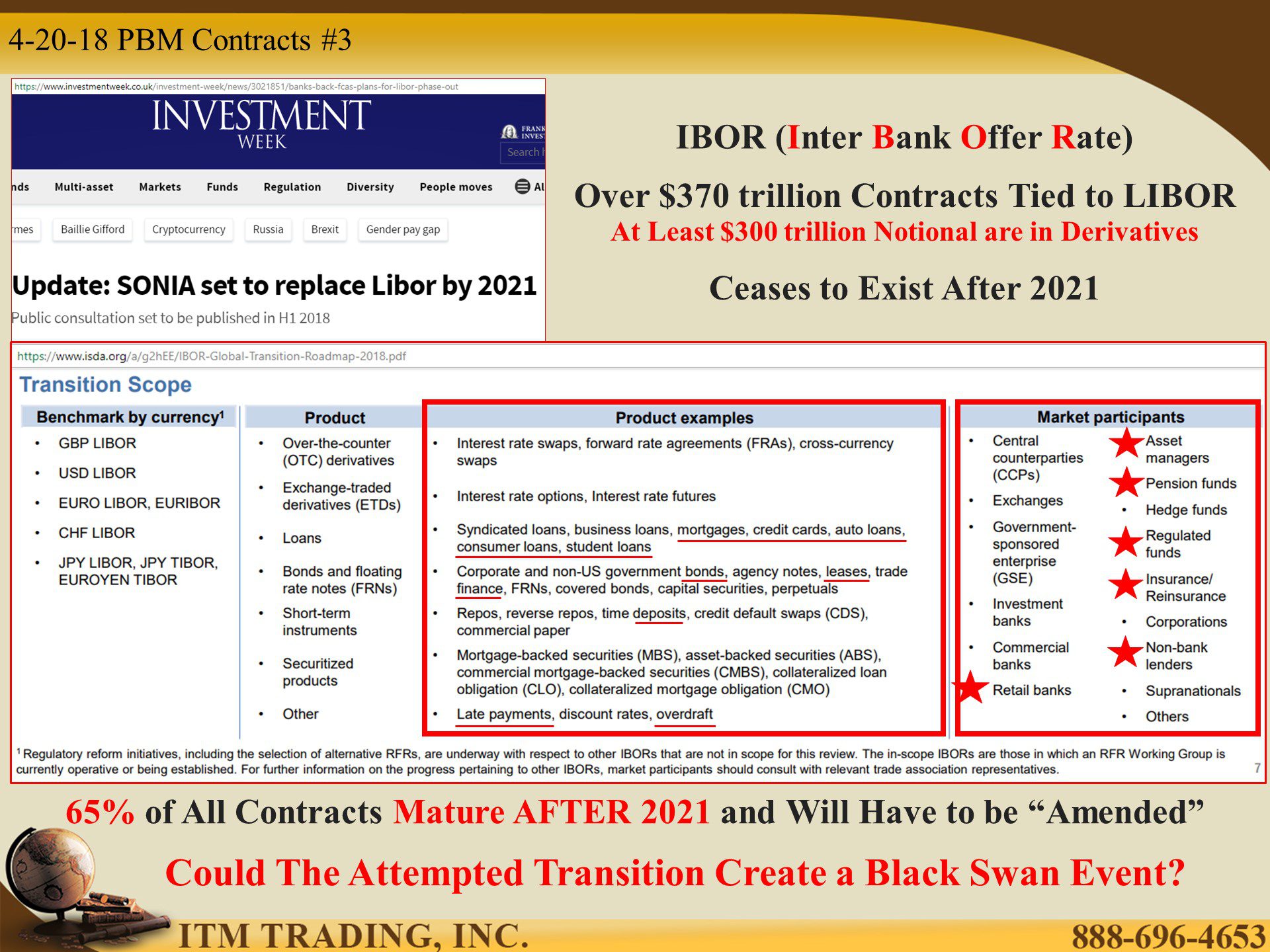

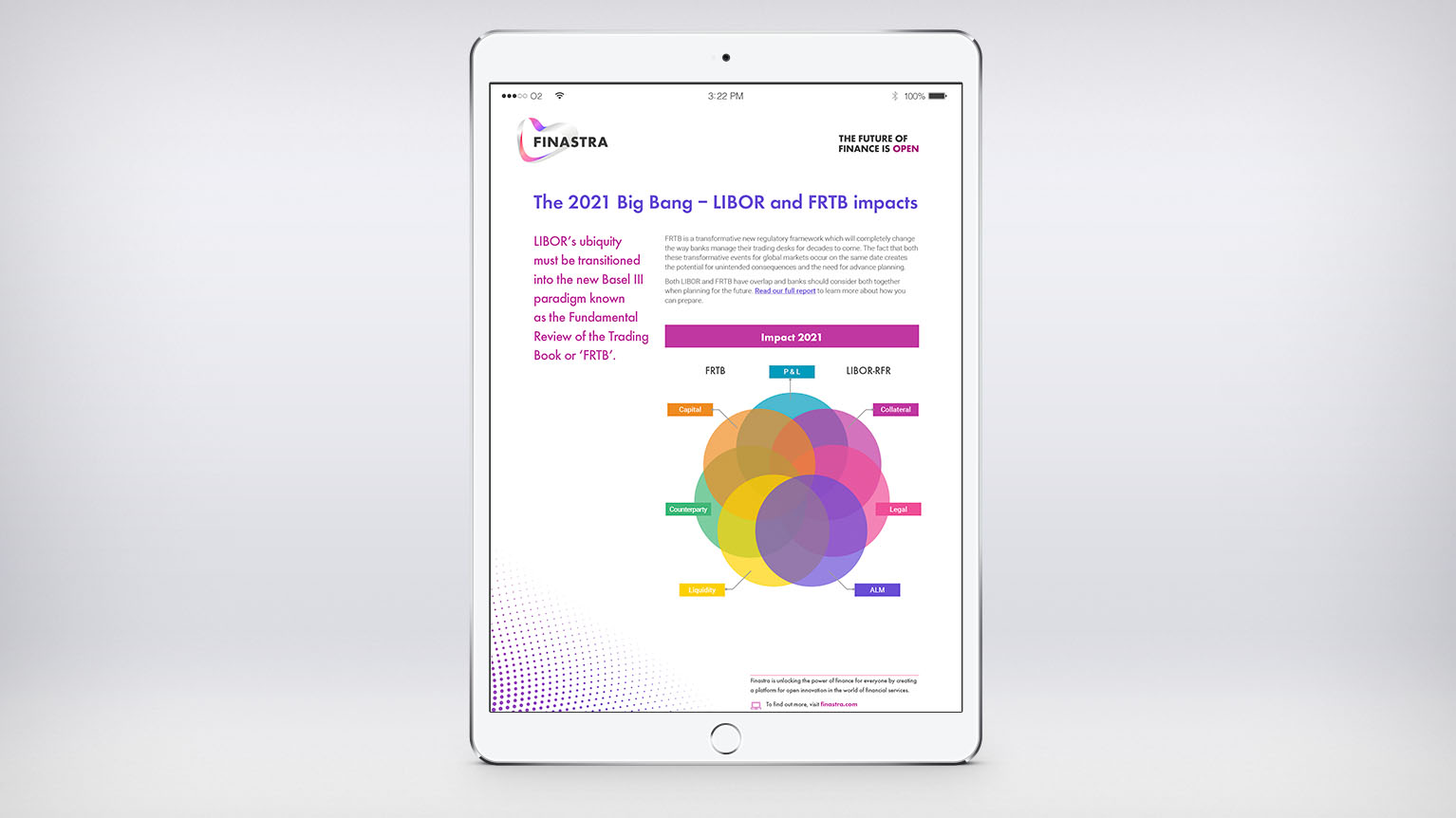

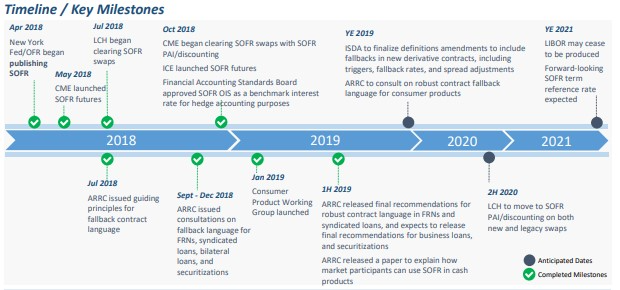

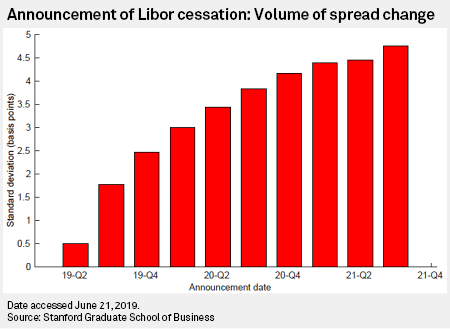

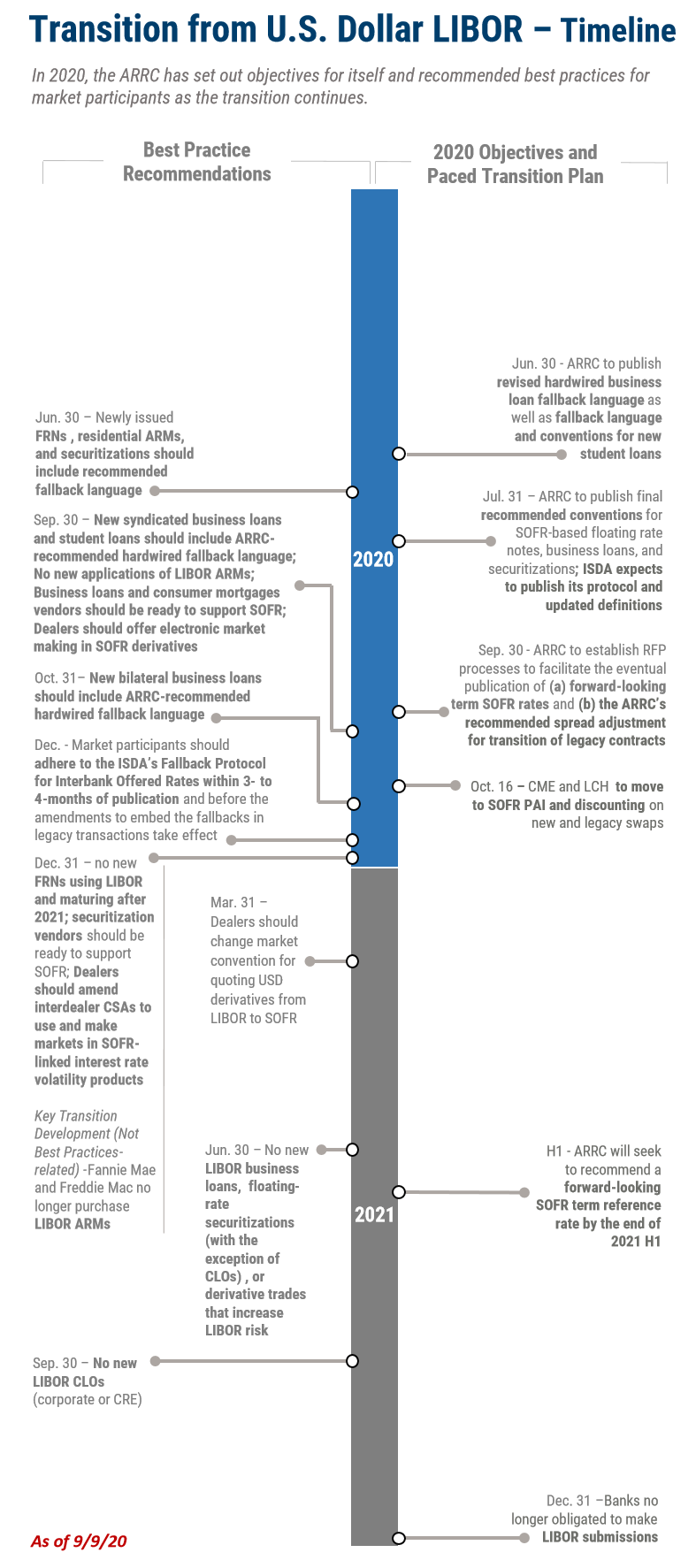

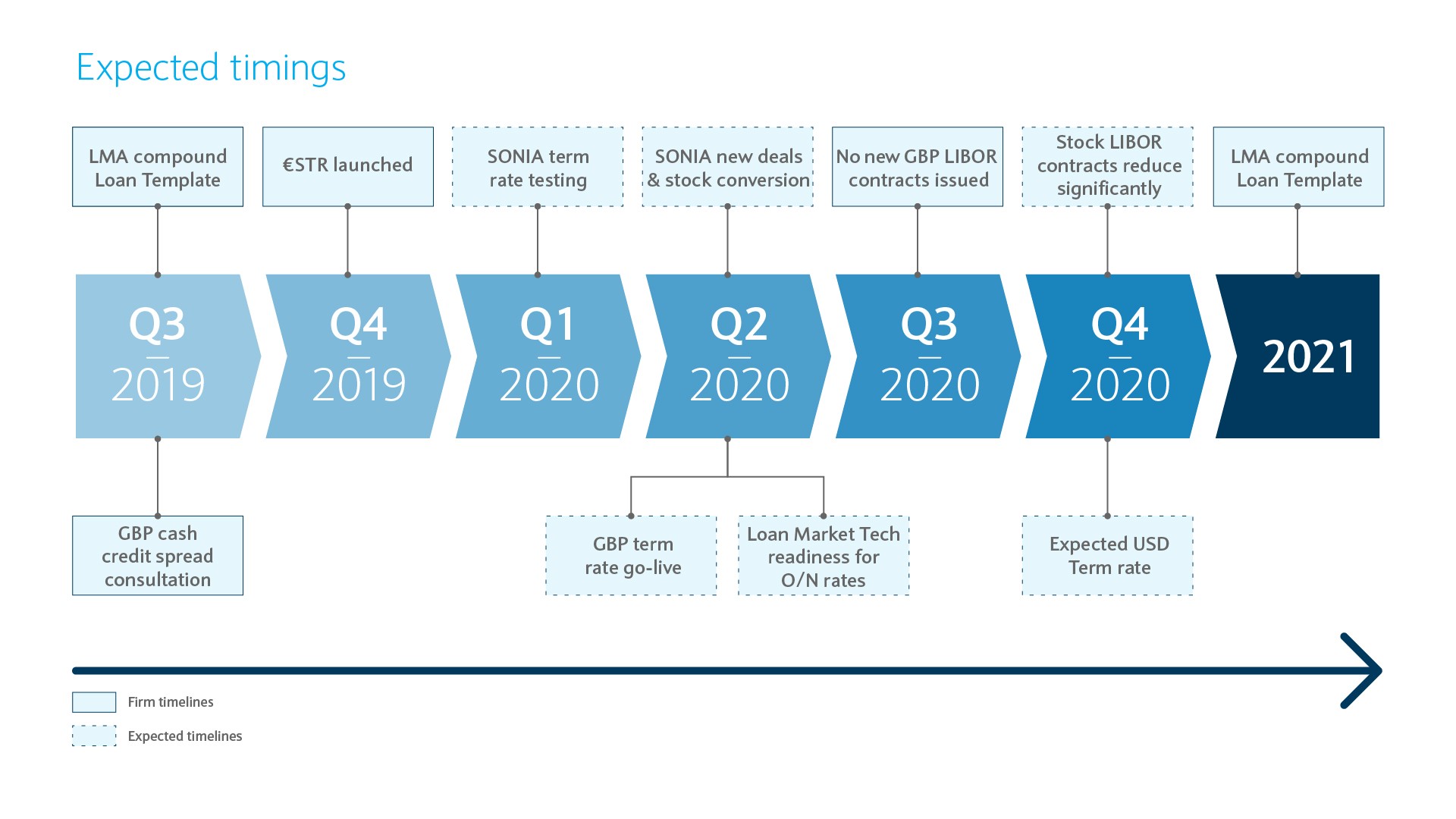

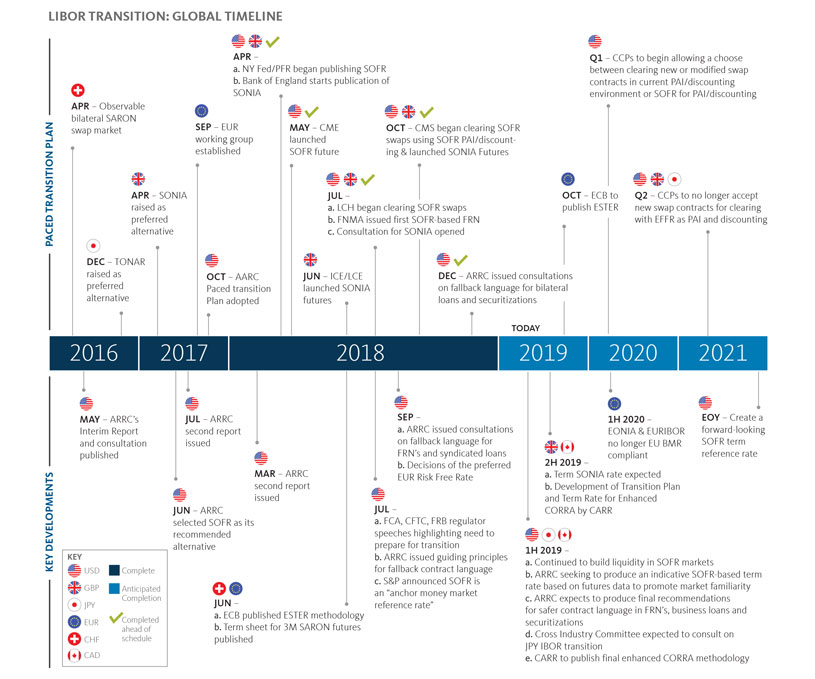

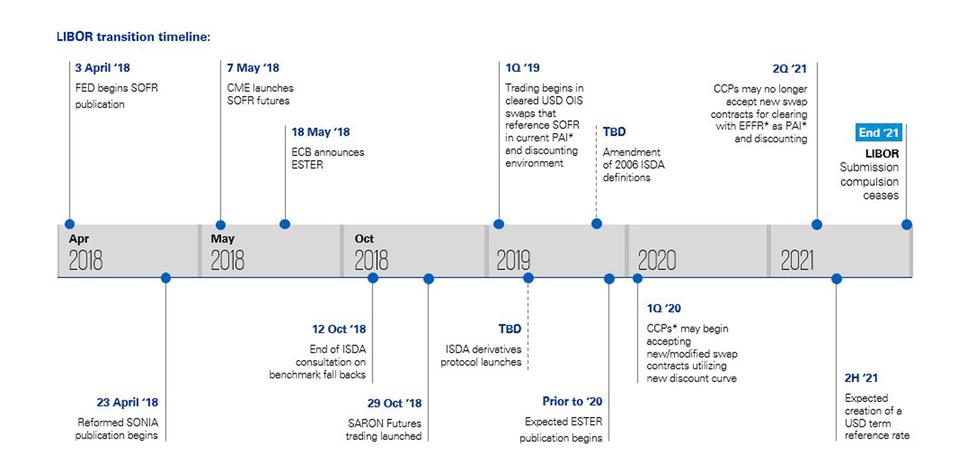

Libor 2021. According to the fca libor is set to be phased out by the end of 2021. Join us for a client webinar. The shift away from the most widely used interest rate benchmarks is an immense change to global finance that will have far reaching impacts.

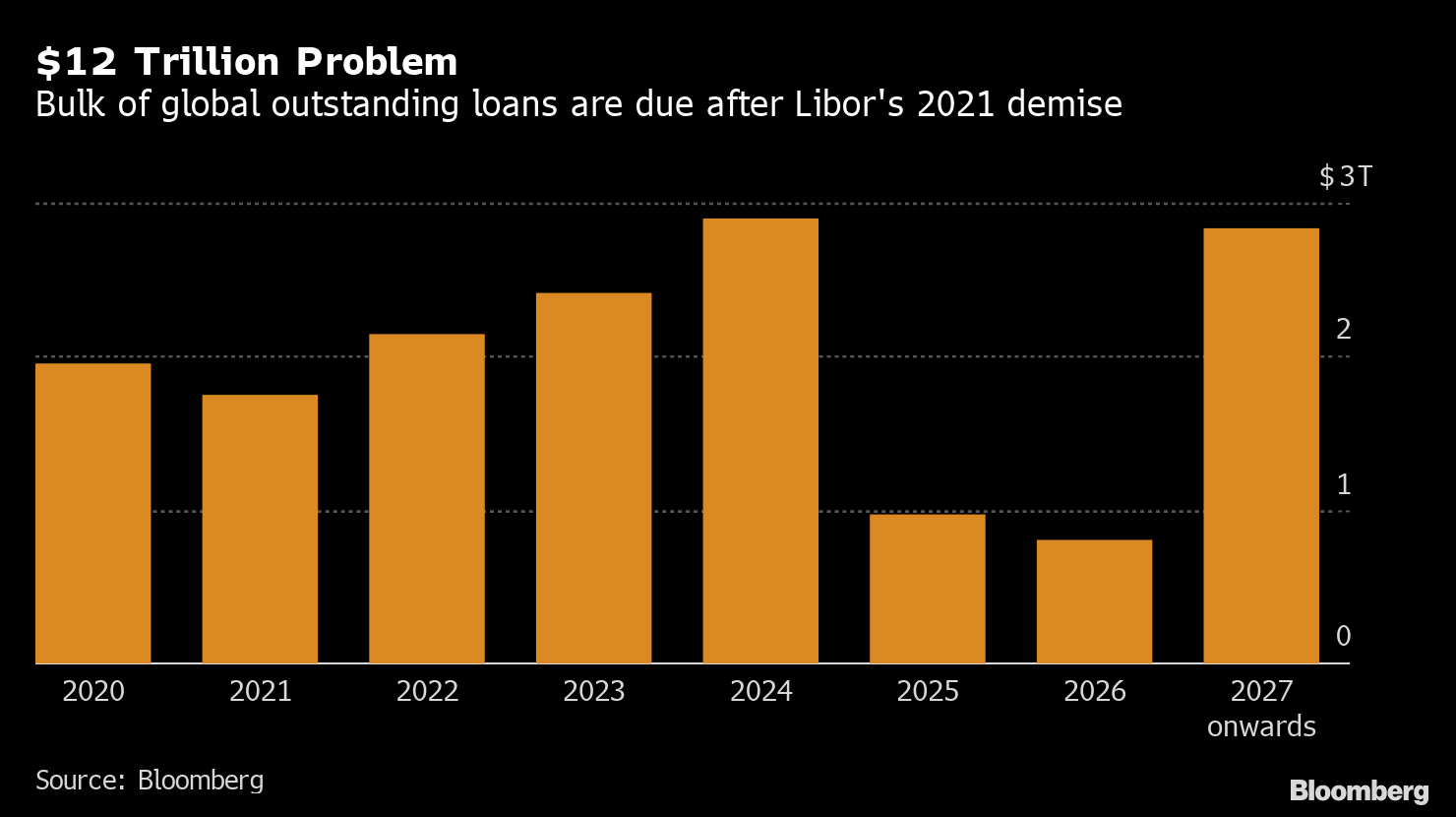

Now libor is going away. Much of this cost is linked to the arduous task of changing the terms of contracts tied to libor whose duration extend beyond the 2021 deadline. The clock is ticking.

What does this mean for investors. British regulators said thursday that they wanted to phase out the scandal plagued interest rate by 2021 replacing it with new measures more closely tied to the lending. Progress has been held up not only by nervous.

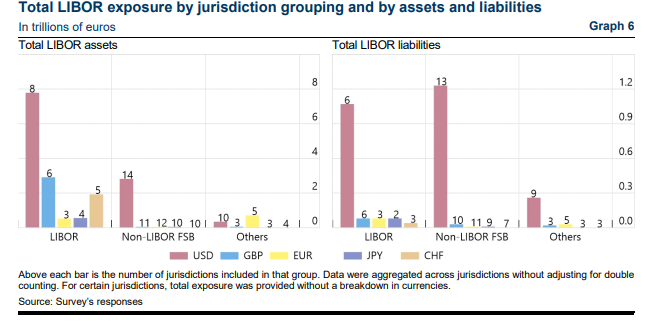

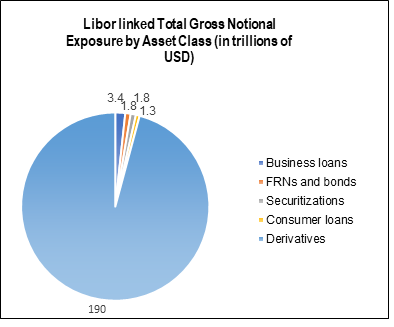

You might have heard that libor is going away. Find out more about ongoing transition initiatives and actions we are taking to facilitate the transition. Libor currently underpins around 400 trillion in financial contracts for derivatives bonds mortgages commercial and retail loans but it is scheduled to be phased out by the end of 2021.

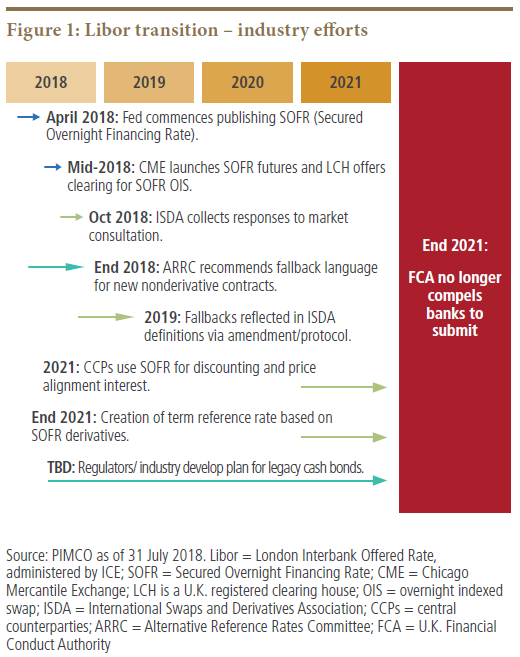

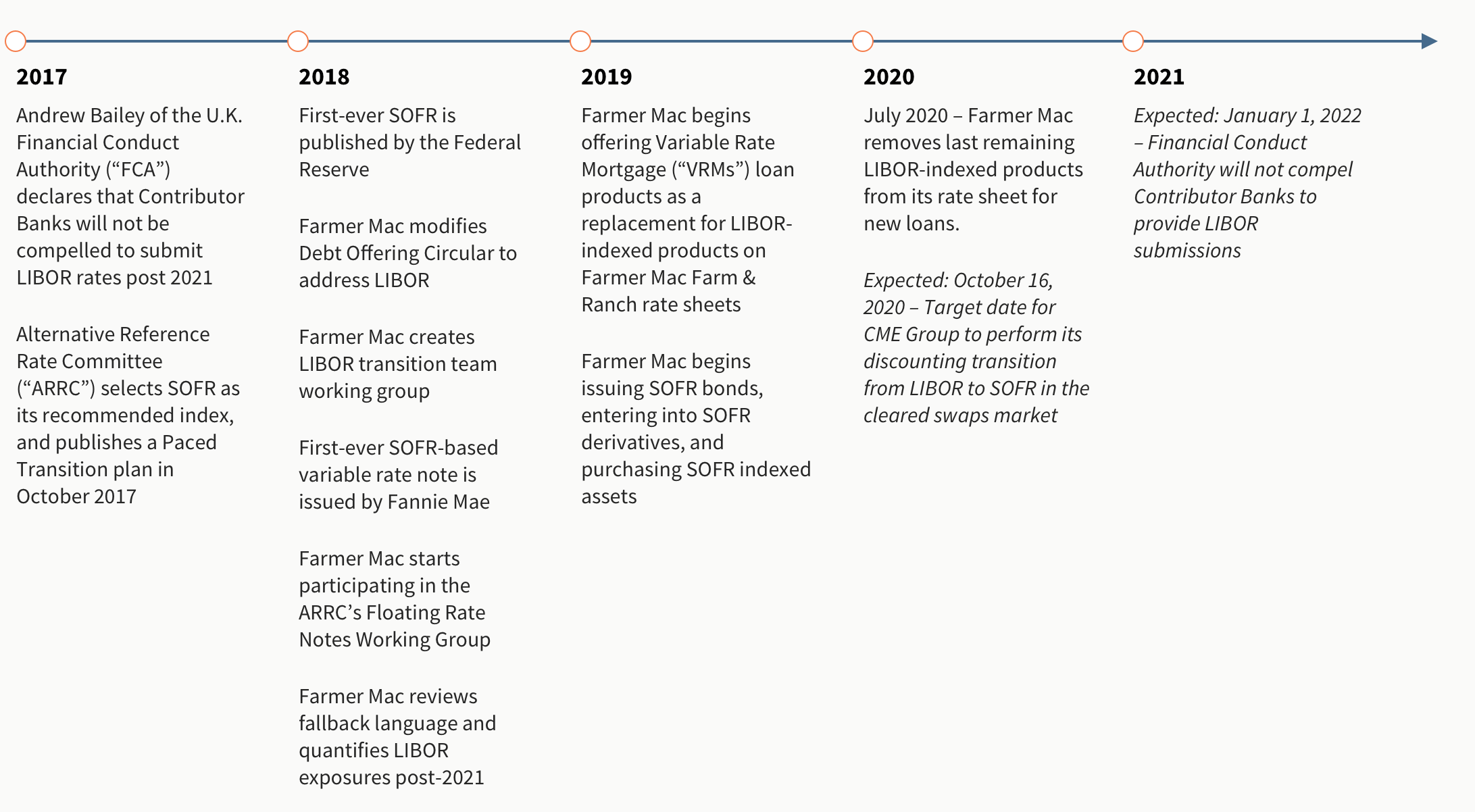

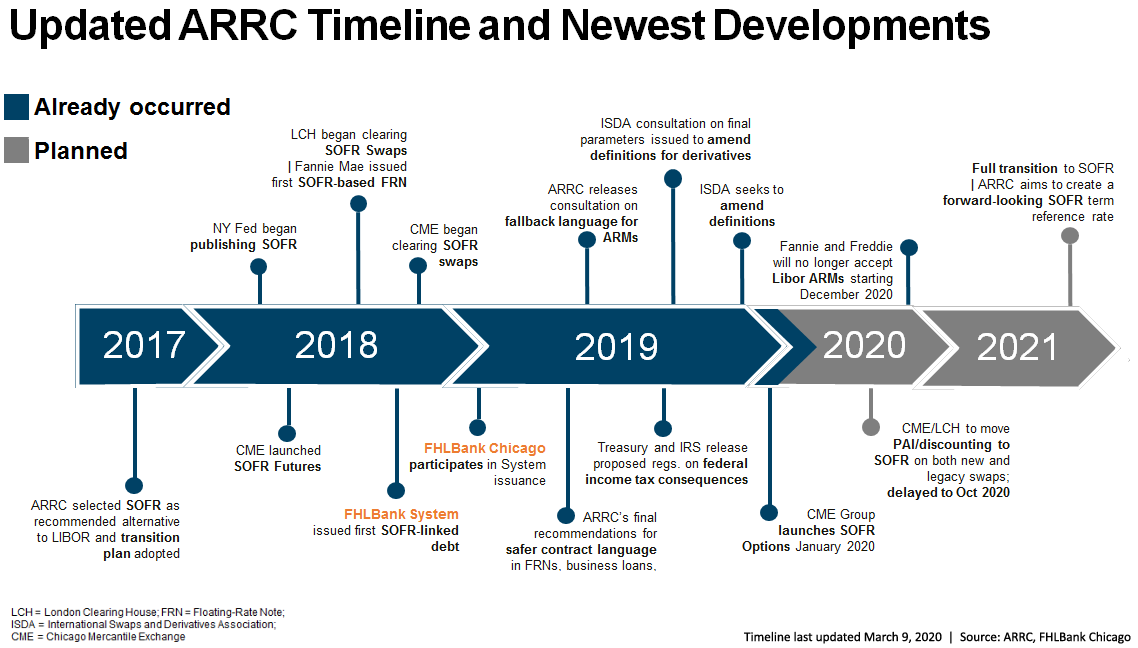

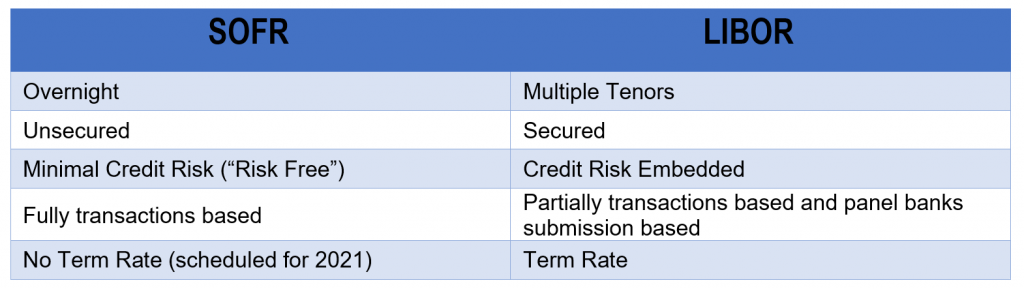

In june 2017 the alternative reference rates committee selected sofr as its recommended alternative to libor. Here s what you need to know about libor and adjustable rate loans. Here is information to help consumers understand whether this market wide change might affect the terms of their loans.

It s possible that rates based on libor could continue to be published after that point. Fca says libor is ending in 2021 andrew bailey chief executive officer at financial conduct authority explains the decision to end libor in 2021 in favor of a more reliable system. The interest rate benchmark libor is expected to cease after end 2021.

As the successor to libor rates. Usd libor s formal retirement is set for the end of 2021 but that timeline isn t absolute. Firms must transition to alternative rates before this date.

.png)

.jpg.aspx?width=650&height=370)